Portfolio math for a venture capitalist is pretty simple. Assume a VC has $10 million to invest and they are aiming for a 20% return:

- Invest 1MM in 10 companies

- 7 will fail

- 2 return their money

- One is a 10x return

- 10MM invested, return 12MM for a 20% return

But that assumes that money is returned immediately. Realistically, those returns are happening 5-10 years after the money is invested. If you return 20% over 5 years, that is a 4% annual return which is dog shit. To make this math work over even the shortest timeframe, you need something more like this:

- Invest 1MM in 10 companies

- 7 will fail

- 2 return their money over 5 years

- One is a 20x return over 5 years

- 10MM invested, return 22MM for a 120% total return

- Over this 5 year period the fund has achieved a 17% annual return. Over 10 years this is an 8% annual return.

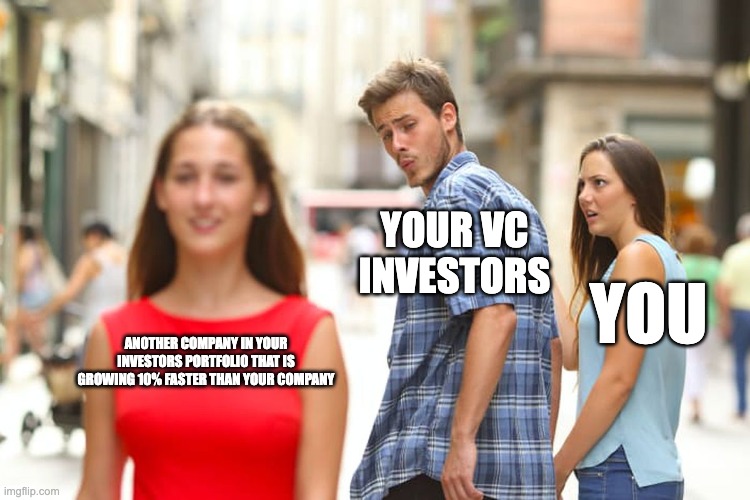

This math works for VCs and LPs. It’s a nightmare for founders.

This math means that VCs are hunting for that absolute unicorn, that 20x+ return; everything else is collateral damage.

VCs know that to maximize the chances for a 20x return, they have to have several of the following:

- First to market

- Huge TAM

- Huge growth rates

- Extreme product market fit

- Fantastic margins

Scaling fast is the name of the game. This makes VCs push founders to spend like crazy to achieve growth and either fail quickly or have wild success.

Think about that for a minute. As a founder, you are pouring your heart and soul into your company. It’s disrupting your daily life, stealing your time, potentially causing you to have poor relationships with your family and friends. But you are doing this because you believe in what you are building, or maybe you enjoy running the show. Now an investor comes along, gives you some money, and tells you to put all of that at risk because the best chance they have to produce an outsized return is to identify their one homerun investment quickly and let all of the others fail.

VC math is so ingrained in investors that the needs of the individual company are completely lost in the math of a winning portfolio. There is no nuance to the “help” that many VCs give their portfolio companies, it’s simply “spend money, grow as fast as possible, if you run out of cash and can’t raise again then get out of my way. VCs make their returns; individual founders get screwed.